Cyril Amarchand Mangaldas has acted on $40.4bn worth of mergers and acquisition in the 2016 calendar year, according to researcher mergermarket, with AZB & Partners having recorded $30.1bn of M&A deals in the same period.

According to the data disclosed by firms to mergermarket and independently researched by the organisation, those two firms also topped the league table by volume, with AZB having acted on 62 deals and Cyril Amarchand on 59.

The next two firms in the list - Khaitan & Co and Shardul Amarchand Mangaldas had nearly comparable deal volumes, at 54 and 46 respectively, though their values were much smaller than the two front-runners’.

Khaitan & Co had acted on $16.7bn of M&A deals, and Shardul Amarchand on $10.3bn.

J Sagar Associates (JSA) was fifth in terms of values ($8.1bn) and sixth by volumes (32 deals), while Trilegal recorded one more deal at 33, though the values of its deals ($2.8bn) placed it only in ninth position.

Also read: 2015 mergermarket league tables.

Everyone up (but one)

Talwar Thakore & Associates (TTA) and Vaish Associates also saw a big spike of 361% and 266% respectively, bringing TTA into sixth place with $7.3bn in 4 deals.

Nearly all the top 10 firms by value saw significant spikes in deal values this year - Cyril Amarchand saw an astounding 648% increase over its figures of $5.4bn last year, while AZB’s values grew by 147%, Khaitan’s by 126% and JSA by 113%.

The one notable exception is Luthra & Luthra, which according to mergermarket’s data was the only firm in the 2016 top 10 by value to have worked on a lower aggregate value of M&A deals this year than last at $2.2bn (32% less than its tally in 2015 of $3.2bn).

That brought Luthra a dive to 10th in those rankings from 7th place in 2015, which followed a drop in deal values of 40% from its 4th place in the 2014 M&A league table.

An all-round good year

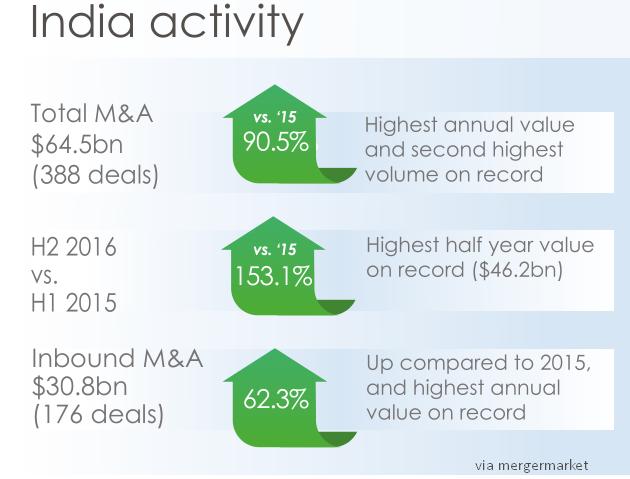

Luthra's performance bucks the overall market: India and most its law firms (in contrast to a slowdown in the rest of Asia) benefited from a bumper year in M&A activity in India, which was up 90.5% to make it oneo of the best on record, according to mergermarket:

India has been a bright spot for Asian M&A activity during 2016, with 388 deals worth US$ 64.5bn up 90.5% by value compared to 2015 (421 deals, US$ 33.9bn) to reach its highest annual total on record.

According to Mergermarket intelligence, the Indian chemicals industry is expected to see an increased number of deals in 2017 on the back of a relative slowdown in Chinese manufacturing sector and growing appetite of multinationals to expand their presence in the country. The main areas of interest are speciality chemicals, aroma chemicals, agro chemicals, flavour and fragrances, and niche chemicals.

The law of averages

When averaging out reported deal values across the total number of deals, a parallel view emerges.

TTA had the largest average deal size, having only acted on 4 recorded M&A deals with a mean value of $1.8bn.

Trilegal had the lowest average deal size at only $85m. Cyril Amarchand and AZB by contrast had average deal sizes of $685m and $485m, with Khaitan on $309m, Shardul Amarchand on $224m, and JSA on $224.

Like TTA, S&R Associates too punched heavily on a few deals, tallying $4bn in 5 deals, averaging out to $800m.

Separate foreign law firm rankings to follow.

2016 M&A league table by value

| Rank | Firm | 2016 Value ($m) | 2016 Deal Count | 2015 Value ($m) | 2015-16 % Val. Change | 2016: Avg size per deal ($m) |

| 1 | Cyril Amarchand Mangaldas | 40,425 | 59 | 5,413 | 646.8% | 685 |

| 2 | AZB & Partners | 30,058 | 62 | 12,195 | 146.5% | 485 |

| 3 | Khaitan & Co | 16,706 | 54 | 7,381 | 126.3% | 309 |

| 4 | Shardul Amarchand Mangaldas & Co | 10,284 | 46 | 5,994 | 71.6% | 224 |

| 5 | J Sagar Associates | 8,173 | 32 | 3,844 | 112.6% | 255 |

| 6 | Talwar Thakore & Associates | 7,282 | 4 | 1,581 | 360.6% | 1821 |

| 7 | S&R Associates | 4,024 | 5 | 2,284 | 76.2% | 805 |

| 8 | Vaish Associates | 3,082 | 6 | 842 | 266.0% | 514 |

| 9 | Trilegal | 2,792 | 33 | 2,443 | 14.3% | 85 |

| 10 | Luthra & Luthra | 2,183 | 17 | 3,201 | -31.8% | 128 |

| 11 | Nishith Desai Associates | 2,131 | 13 | 2,057 | 3.6% | 164 |

| 12 | Veritas Legal | 1,928 | 18 | 230 | 738.3% | 107 |

| 13 | Platinum Partners | 1,635 | 7 | 763 | 114.3% | 234 |

| 14 | Crawford Bayley & Co | 1,400 | 1 | 899 | 55.7% | 1400 |

| 15 | IndusLaw | 1,339 | 9 | 1,481 | -9.6% | 149 |

Source: mergermarket

2016 M&A league table by volume

| Rank | Firm | Value ($m) | Deal Count | Value ($m) | Deal Change |

| 1 | AZB & Partners | 30,058 | 62 | 85 | -23 |

| 2 | Cyril Amarchand Mangaldas | 40,425 | 59 | 34 | 25 |

| 3 | Khaitan & Co | 16,706 | 54 | 53 | 1 |

| 4 | Shardul Amarchand Mangaldas & Co | 10,284 | 46 | 34 | 12 |

| 5 | Trilegal | 2,792 | 33 | 30 | 3 |

| 6 | J Sagar Associates | 8,173 | 32 | 38 | -6 |

| 7 | HSA Advocates | 408 | 21 | 10 | 11 |

| 8 | Bathiya Legal | 197 | 19 | 15 | 4 |

| 9 | Veritas Legal | 1,928 | 18 | 6 | 12 |

| 10 | Luthra & Luthra | 2,183 | 17 | 20 | -3 |

| 11 | Desai & Diwanji | 644 | 17 | 27 | -10 |

| 12 | BMR Legal | 965 | 15 | 21 | -6 |

| 13 | Nishith Desai Associates | 2,131 | 13 | 19 | -6 |

| 14 | IndusLaw | 1,339 | 9 | 14 | -5 |

| 15 | Krishnamurthy & Co | 685 | 9 | 9 | 0 |

| 16 | Tatva Legal | 331 | 9 | 9 | 0 |

| 17 | PDS Legal | 101 | 8 | 8 | 0 |

| 18 | Platinum Partners | 1,635 | 7 | 8 | -1 |

| 19 | Vaish Associates | 3,082 | 6 | 5 | 1 |

| 20 | Phoenix Legal | 253 | 6 | 4 | 2 |

| 21 | Economic Laws Practice (ELP) | 144 | 6 | 8 | -2 |

| 22 | DSK Legal | 15 | 6 | 12 | -6 |

Source: mergermarket

Methodology

Legally India has no responsibility for the figures pubilshed, much of which has been shared by law firms' communications teams with mergermarket and other league table providers. According to mergermarket:

All data is based on transactions over US$ 5m and is based on Mergermarket’s M&A deals database. Deals with undisclosed deal values are included where the target’s turnover exceeds US$ 10m. Deals where the stake acquired is less than 30% will only be included if the value is greater than US$100m.

threads most popular

thread most upvoted

comment newest

first oldest

first

These deal tables are prepared by Mergermarket (www.mergermarket.com/info) which, if you do things like google searches, will show you is a global company that does reporting internationally. Perhaps you should read the above article in its entirety.

Stop moaning, and ask your firm to get its act together and start reporting to mergermarket and other league table providers. Reporting is free.

A wellwisher

This not a Government organization. You should be knowing, how these organization works. And please read to Advocates Act.

threads most popular

thread most upvoted

comment newest

first oldest

first