From Mon day, 9 March 2015, a special Supreme Court bench comprising of two seasoned tax hands, Justice AK Sikri and Justice RF Nariman, began exclusively hearing and deciding tax cases from Monday to Friday.

According to the apex court registry, 10,843 civil cases relating to taxation were pending before the Supreme Court.

Tax cases alone account for nearly 18% of all cases pending in the Supreme Court.

At present about 386 cases are proposed to be heard before the bench (of which twenty were on Monday’s list), and the move has been hailed across the board as a good one.

“No country in the world have so many tax cases in front of the Supreme Court. Tax disputes are complex and involve huge stakes,” commented Nishith Desai, managing partner of Nishith Desai Associates, calling it a “very helpful and important step”.

The new bench comes at a time when concerns have been expressed, even from within the Court, that the Supreme Court has been in an 'institutional drift', moving away from important cases, such as constitutional cases, and focusing far too often on routine, and mundane matters that it should not be worrying about in the first place.

Evidence of this drift is clear in tax cases too.

Tax cases, even those that don’t have a constitutional question at stake, affect not just the taxpayer in that immediate instance but hundreds and thousands of other taxpayers in similar positions. The government is also impacted, increasing its difficulty in estimating revenues due to uncertainty in outcomes of cases that can remain pending to judicial determination for many years.

Furthermore, being the apex court, delay in disposing tax cases adds to greater uncertainty lower down the judicial chain, as high courts take contrary views on similar issues and further litigation is spawned as a result.

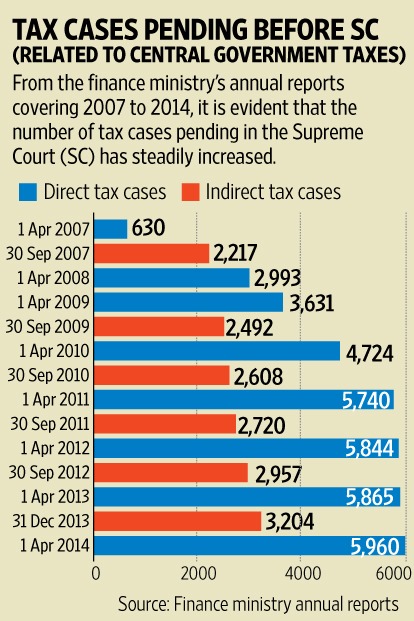

From the numbers released by the Ministry of Finance in its annual reports covering 2007 to 2014, it is evident that the number of tax cases pending in the Supreme Court have been on a steady rise in the past seven years.

Direct tax cases (including income tax and wealth tax) pending at the apex court have doubled between April 2008 and 2014 to 5,960 cases, while indirect tax cases (customs, central excise and service tax) cases pending there have jumped from 2,217 in September 2007 to 3,204 by the end of the 2013 calendar year.

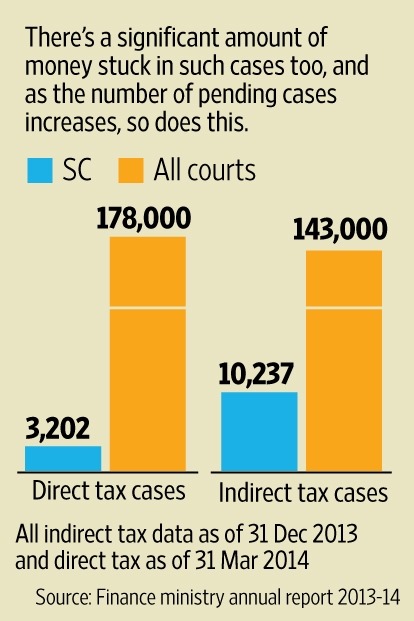

As of 31 December 2013, Rs 10,237 crores were locked up in indirect tax appeals in the Supreme Court. A total of Rs 1.43 lakh crore in indirect taxes were stuck in litigation before the Supreme Court, high courts and appellate tribunals of customs excise and service tax (Source: finance ministry annual report 2013-14)

As far as direct tax cases are concerned, Rs 3,202 crore was locked up in litigation in the Supreme Court as of April 2014, whereas about Rs 1.78 lakh crores were held up in litigation in other forums (Source).

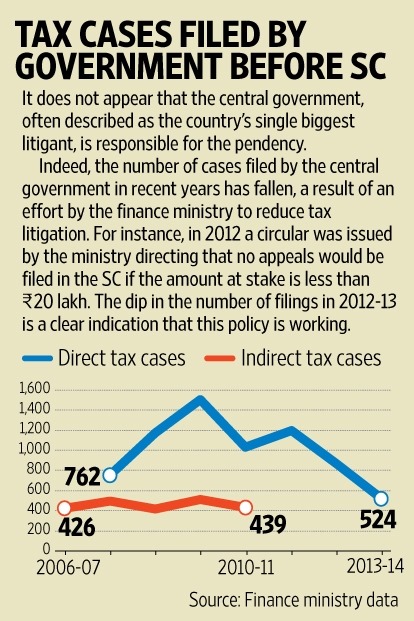

Could increased filing of cases by the Central Government, often described as the country's single biggest litigant, be responsible for the pendency? The numbers do not suggest so.

The figures for government-filed tax cases before the Supreme Court (as seen from the annual reports of the Finance Ministry) have actually decreased or stayed about the same in recent years, where data is available, standing at only 524 indirect tax cases filed in 2013-14 and 439 in 2010-11.

The reduction in the number of cases filed is at least in part due to a conscious effort on the part of the finance ministry to reduce tax litigation. Circulars are issued on a regular basis directing that appeals will not be filed before a higher court if the value of the tax in dispute is below a certain limit.

For instance, in 2012 a circular was issued directing that no appeals will be filed in the Supreme Court if the amount at stake is less than Rs 20 lakhs. The dip in the number of filings in FY 2012-13 is a clear indication of this policy working.

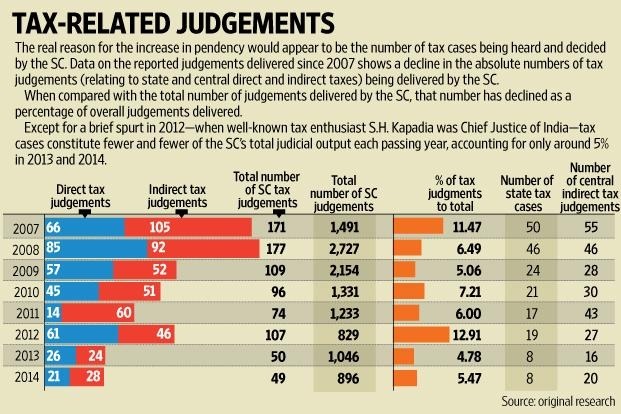

The correct explanation for the rise in the pendency is more likely to lie in the declining number of tax cases being heard and decided by the Supreme Court.

A survey of the reported judgments delivered since 2007 shows a decline in the absolute numbers of tax judgments (relating to state and central direct and indirect taxes) being delivered by the Supreme Court.

When compared to the total number of judgments delivered by the Supreme Court, that number has declined as a percentage of overall judgments delivered by the Supreme Court.

Except for a brief spurt in 2012 – when well-known tax enthusiast SH Kapadia was Chief Justice of India (CJI) - tax cases constitute fewer and fewer of the Supreme Court’s total judicial output each passing year, accounting for only around 5 per cent in 2013 and 2014.

J Sikri, is a former CJ of the Punjab and Haryana High Court. He was first elevated as a judge of the Delhi High Court, where he headed the tax bench dealing with income tax cases, including several leading cases relating to international taxation.

J Nariman, who was elevated directly from the Supreme Court Bar, was also Solicitor General of India in which capacity he appeared before the Supreme Court of India in a number of leading tax cases, including the Vodafone tax dispute.

But it is not just a game of quantity the Supreme Court will have to play; qualitatively too its focus in tax matters is hoped to improve, and having two judges with strong tax pedigree in charge, can only help here. (see box)

“A specialised tax bench would be in a better position to dispose of the cases faster in a judicious manner, especially because judges would have deep understanding of not only tax laws but also of the constitution and other laws,” commented Desai.

Not all of the pending cases, for instance, will require separate full-fledged hearings since the total pendency number includes recurring disputes, which haven’t yet been resolved by the Supreme Court, could be resolved together in one hearing.

“Tax is a complicated area of law and hence it requires special attention,” agreed Sameer Jain, tax lawyer and founding partner of Pamasis Law Chambers. “Constitution of a dedicated tax bench will not only bring focus to new as well as long-pending matters, it will also bring consistency to the orders passed in identical cases. This move will bring confidence to litigants.”

In addition, the Supreme Court finally deciding outcomes in long pending tax disputes could also have the beneficial cascading effect of reducing the pendency of cases on similarly taxing legal questions that are pending in the high courts and tax appellate tribunals.

The special tax bench could therefore have not come sooner.

Additional research by Shubham Jain and Aayushi Agarwal.

Alok Prasanna Kumar is a senior resident fellow of the Vidhi Centre for Legal Policy focusing on judicial reform.

This article was first published in Mint. Mint’s association with LegallyIndia.com will bring you regular insight and analysis of major developments in law and the legal world.

{tag}link rel='canonical' href="http://www.livemint.com/Politics/zS9slLqZu3ySWkAHEBvv6M/Why-the-Supreme-Courts-tax-bench-is-timely.html"{/tag}

threads most popular

thread most upvoted

comment newest

first oldest

first

threads most popular

thread most upvoted

comment newest

first oldest

first